Investing with ESG Data

Extra special goodness: ESG is the secret ingredient

Investing is like cooking: Most people aren’t great at it, but they keep slogging away, doing the best they can, because they can’t afford to pay someone else to do it for them. There are entire cable television networks that exist to help people kick their culinary and financial skills up a notch. Plus we’re pretty sure we remember seeing Guy Fieri ring the opening bell at the New York Stock Exchange one time, so this is essentially a perfect metaphor.

Anyway, if you’re an average investor (or ingester), you’re always eager to discover a secret ingredient that the pros use, and try it out for yourself. Well, it won’t necessarily help your cooking, but on the finance side, perhaps it’s time to develop a taste for ESG.

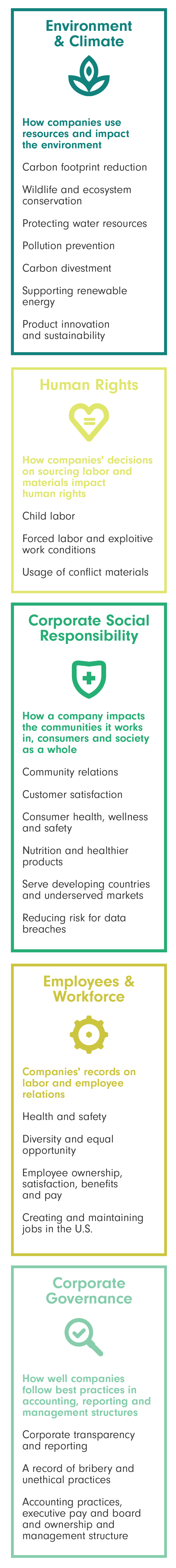

ESG stands for environment, social and corporate governance—three areas of corporate policy and behavior that can provide investors with valuable insight that goes beyond standard financial metrics. In recent years, it has become increasingly common (and fruitful) to integrate ESG analysis into traditional numbers-only stock research.

Millions of ESG data points quantify a company’s practices and performance in areas from human rights to carbon footprint to corporate transparency. Analysis of ESG data enables investors to know a whole lot more about the companies they invest in. And it turns out, having more information to base your decisions on is a good thing for your portfolio: Strong ESG performance is related to strong financial performance.

Free-range information: sourcing ESG data

Chefs pride themselves on sourcing the finest, freshest most local ingredients to add flavor and cache to their cooking. For analysts, sourcing the ideal data is a little more difficult than a quick trip down to the farmer’s market.

ESG data come from many different sources. Some information, like progress on corporate social responsibility programs, is voluntarily self-reported by firms. Some is required by regulatory agencies such as the Securities and Exchange Commission or Occupational Safety and Health Administration. Some is sussed out by analysts and software tools from publicly available information like annual reports, or employee-generated ratings from sources like glassdoor.com.

The data can be researched and assembled by individuals, investors or analysts, but they are quite often acquired through subscription services from companies like MSCI or CSRHub.

Not all profits are created equal

ESG data can help fill in the gaps that are left out by financial analysis alone. In the past, we measured company performance primarily by financial factors—the only information that was readily available. Financial metrics can hint at how well a company is managed, how well-prepared it is for avoiding or dealing with accidents or disasters, how well it treats its employees, and other important non-financial indicators of success.

But now, with the availability of ESG data, we can rate companies on all those criteria in the same concrete way we might assess their price-to-earnings ratios or market capitalization.

ESG research can help you understand risk, and to some extent, mitigate it. For example, if Company A and Company B have similar financial performance, they might seem interchangeable in your portfolio. But, if you knew Company A was run with a proactive stance on its future sustainability, and Company B was able to achieve soaring short-term profits only because it had used dark sorcery to amass an underground army to do its bidding, that would probably change how you view those investments.

You can’t ever really know which company will perform best, or whether one might implode without warning. But by analyzing ESG data, you can learn more about how a company is managed, how prepared they are for risks, and how they are planning for their future. Knowing that there is a difference in management practices helps you put their profits in context.

Photo credit: Dawn Endico

Ultimately, when you are choosing where to invest your money, don’t you want to know more about how a company generates its profit?

ESG and the mindful investor

ESG research offers a glimpse into companies’ character and values. And you can use that information to better align your portfolio with your personal values and your investment goals.

Maybe you have a moral objection to companies that profit from war or engage in shady labor practices. Or, maybe you want to reward companies that care about diversity, or have women and minorities in leadership positions. Or maybe you just want the security of knowing that the companies you invest in are prepared for the risks they face and are ready for the future.

Whatever your values are, ESG data provide you with more knowledge, so you can assemble a portfolio that aligns with your personal values and provides strong returns. Companies with strong ESG ratings can be highly rewarding investments.

Why doesn’t everyone create a customized ESG-integrated portfolio? Well, it takes a lot of time-consuming and detailed data analysis. There are basically three ways to do it: hire an asset manager, DIY, or choose a predetermined green or socially conscious investment product.

Asset management firms tend to serve an exclusive clientele. If you’re cool with a minimum investment (which is often quite high) and their fee structure, they’ll do all the research, analysis, and management for you. The level of VIP treatment you receive, and how much you pay for it, typically depends on the size of your account.

If you aren’t in a position to hire a wealth manager, and you have the time and mad data analysis skills, you could take a crack at designing your own ESG-driven portfolio. You could dig through reports and subscribe to one or more of the data services that serve the industry. You could crunch all those numbers into some kind of meaningful list of stocks, vet their financial metrics, and then pick the ones with the most promise according to your custom-fit system. But for most of us, the necessary time commitment and technical skill are prohibitive to becoming DIY investment strategists.

If you’re ok with the lowest-effort option, you can seek out a “green” or “socially conscious” mutual fund or exchange-traded fund that is marketed toward investors who share similar values. This may assuage concerns that your dollars are being used for purposes you’d find disagreeable. But it won’t give you the level of detail or personal choice available through building a values-driven portfolio from the ground up.

PSA: How to get that special sauce

If you aren’t a high-net-worth investor, don’t want to try to crunch the numbers yourself, and aren’t happy putting your money in funds built around someone else’s values, there may not be an option out there for you to build an ESG-driven portfolio that aligns with your personal beliefs. That’s why we started Censible. We believe very strongly in ESG integration, and the power of a personalized investment strategy. We think all investors should have that option.

At the end of the day, this is what it’s all about: investing can be about making money, supporting causes, boycotting behaviors you don’t believe in, and many other things. But it should never cost you your integrity.

Our advice? Think about your values. You’ll never go wrong by knowing what you care about. Then start looking for a way to collect and analyze data that satisfies you. Whatever method you choose, adding a little of that secret ingredient to your portfolio can go a long way.

Photo credit: Karen Roe