Risky Business: Top 10 Corporate Crackdowns

What are the 10 largest corporate fines and settlements in history and could a data-driven approach have helped mitigate investment risk?

It’s easy to portray "Big Business" as the bad guy. In the investing business, we usually try to find the good guys. Identifying companies that make a positive impact on their industry or society also can help us uncover strong investments. Despite some arguments that responsible investing flies in the face of fiduciary best practices, a more mindful approach to investing that incorporates Environmental, Social, and Governance (ESG) criteria may identify hidden company risks since business risks don’t always appear on a balance sheet.

Like many investors, when we initiate research to find the good companies, we, at times, also run into the bad ones. We wonder if identifying business risks can help lead investors to spot opportunities in companies with strong ESG practices, quality earnings, or in industries less likely to be entangled with costly regulatory actions. What businesses put its investors and reputation at risk? To this end, we rounded up the 10 largest corporate fines issued by the U.S. government and identified how each company was held accountable for bad behavior. Read on to find out where ESG tools could have helped alert investors in advance or inform investors of future regulatory risk.

#10 Credit Suisse: A garden-variety corporate secrecy mixed with tax evasion, $2.88B

In 2014 the Swiss bank had to fork over $2.88 billion along with pleading guilty to criminal charges of helping U.S. citizens evade taxes. As you may know, this case was part of a long effort by the U.S. Department of Justice to tackle the notoriously secretive practices of Swiss banks.

Divulging the Secrets:

- The investigation led to the criminal indictment of eight Credit Suisse employees.

- While Credit Suisse later pleaded guilty to wrongdoing, the bank was granted an exemption by the SEC to prevent it from losing its investment-advisory license.

- Credit Suisse had been conducting its questionable tactics for over a century.

- The Senate subcommittee disclosed that Credit Suisse helped 22,000 Americans evade taxes, but the bank did not have to reveal its clients' names.

While Swiss banks are known for secrecy, it was no secret that investors should have been more aware of risks given the U.S. government’s crackdown on UBS for helping its wealthier U.S. clients evade taxes in 2008. While the Swiss banks have made progress towards improving the processes and procedures it maintains with tax authorities, international authorities continue to probe the banks, potentially further impacting material and reputational risks in the near-term.

#9 GlaxoSmithKline: Misbranding and hiding safety information, $3B

In 2012 GlaxoSmithKline (GSK) pleaded guilty not only to misbranding the drugs Paxil and Wellbutrin, but also to hiding safety information from the FDA. As a result, GSK was fined $3 billion.

Key Symptoms:

- GSK falsified prices in order to reduce payments to Medicaid so it could overcharge other public health entities.

- GSK sold the popular antidepressant Paxil to adolescents while hiding information about the drug’s lack of efficacy in children.

- GSK branded Wellbutrin, which was approved only as an antidepressant, as a remedy for a host of other health issues including weight loss and sexual dysfunction.

To recap, fraud, rigged prices, false claims, failure to report safety data, and aggressive marketing targeted at physicians to promote the drugs for non-FDA approved uses were among the offenses committed by GSK. While this was the largest settlement ever by a pharmaceutical company, some wonder if the $3 billion fine was punitive enough given the $25 billion in sales from the respective drugs. In case you are wondering, while whistle blowers blew this case open, this was not the Fed’s first large drug bust -- Pfizer settled civil and criminal allegations for illegally marketing a drug in 2009.

#8 Goldman Sachs: Misrepresenting toxic securities to investors, $5B

Did you recall Goldman Sachs getting off the hook for only $550 million? While Goldman did settle for this amount in 2010 for misleading investors in a subprime mortgage product, we have to fast forward to 2016 to see why Goldman makes the list. In April 2016 Goldman Sachs settled for $5.06 billion for misleading investors about residential mortgage-backed securities (RMBS) — in other words, for its role in helping ignite the 2008 Global Financial Crisis.

The Art of these Deals:

- From 2005 to 2007 the company knowingly sold residential mortgage-backed securities full of mortgages that were likely to fail, resulting in the loss of billions of dollars to investors.

- They assured investors that the underlying mortgages backing the securities met certain credit and underwriting standards and practices (which they didn’t).

- $1.8 billion of the settlement will go to helping retail borrowers with loan modifications, loan forgiveness, and financing for affordable housing.

Here’s the kicker: Goldman checked for bad loans, and found LOTS of them in the securitized loan pools. But it turned a blind eye, approved every RMBS they came across in the time period, and sold the securities to investors anyway.

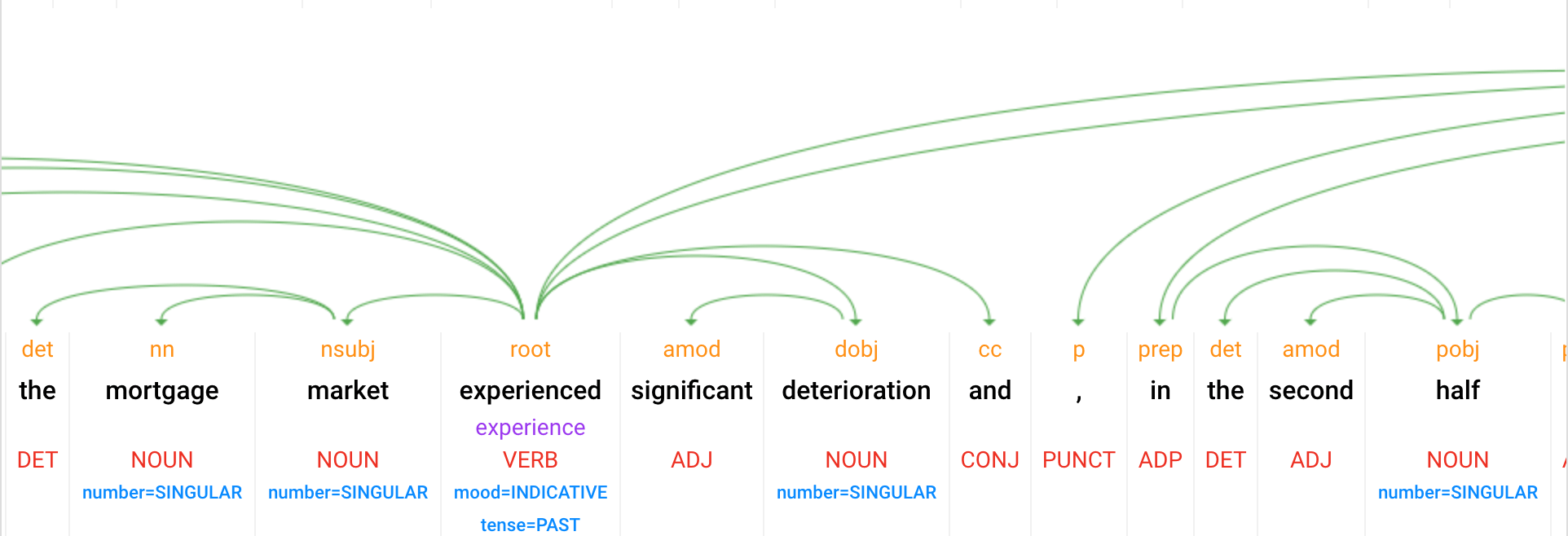

Can the mindful investor at least hope for a silver lining? Taking a big data approach to ESG investing, Censible unleashed its textual analysis tools on Goldman’s 2007 annual report and found the bank mentioned the risks of the mortgage market deteriorating over 50 times, providing significantly more negative sentiment than its peers.

While not innocent, perhaps its more honest risk assessment to shareholders allowed Goldman to better navigate its balance sheet through the financial crisis compared to other banks on our list.

#7 Anadarko Petroleum: Passing the buck on major environmental fines, $5.15B

In 2014 Anadarko was fined $5.15 billion for trying to avoid paying fines for environmental contamination

Merging the Pieces Together:

- This was the largest environmental settlement at the time.

- First, Kerr-McGee was found responsible for decades of environmental contamination issues all over the country.

- As early as 2001, Kerr-McGee plotted to legally separate its assets from a litany of environmental liabilities. In 2005, the company spun off its dirty chemicals business along with all the environmental fines and liabilities into a new company, Tronox. Saddled with huge debt and undercapitalized, Tronox went bankrupt in 2009. SURPRISE!

- All the while, Kerr-McGee’s valuable oil and gas assets sat safely, profiting under a separate business umbrella. Those lucrative petroleum-based profits were gobbled up by Anadarko, which acquired Kerr-McGee three short months after the spinoff of Tronox.

Kerr-McGee simply could not just spin off its environmental liabilities to wash its hands clean. Ultimately, this settlement may have set a new standard in financial liability for environmental violations. The EPA previously had not reached similar settlement amounts that the SEC had with banks, but with the #3 and #1 settlements on our list also pertaining to environmental damages, investors may want to place greater focus on analyzing the environmental factors of ESG data to help determine which companies are performing better to mitigate potential environmental risks.

#6 Citigroup: Another bank, more bad mortgages, $7B

In 2014 Citigroup settled with federal and state agencies for $7 billion for its role in the 2008 financial crisis.

Foreclosing on the Key Points:

- The DoJ charged that Citi knew the mortgages it had sold were bad while representing the securitized mortgages as good investments.

- The DoJ discovered an employee’s internal email saying he "went through the Diligence Reports and think[s] [they] should start praying … [he] would not be surprised if half of these loans went down … It’s amazing that some of these loans were closed at all."

- The settlement does not absolve the bank or its employees from facing potential criminal charges.

The $7 billion fine may seem paltry considering Citigroup spent $800 million on a year old hedge fund with mediocre returns in 2007 it shuttered one year later. This tops its $400 million splurge in 2006 on the largest sports stadium naming-rights deal to date. Even at the time, buying stadium-rights hadn’t exactly worked out well for bank stocks.

Citigroup wasn’t the only bulge bracket to get out over its skis. Read on to find out which other banks contributed to the global financial crisis.

#5 BNP Paribas: Flouting US economic sanctions, $8.9B

In 2014 BNP Paribas, pleaded guilty to illegally processing transactions from 2004-2012 through the U.S. financial system from countries that were under U.S. economic sanctions such as Sudan, Iran, and Cuba.

Dictating the Details:

- The bank went to extraordinary lengths to cover up illicit transactions, conceal its tracks, and deceive U.S. authorities.

- While under investigation, BNP also refused to cooperate with the Department of Justice investigation.

- All told, $8.8 billion was funneled illegally through the U.S. financial system.

- In the words of Assistant Attorney General George Caldwell, "BNP Paribas deliberately disregarded U.S. law, of which it was well aware, and placed its financial network at the services of rogue nations, all to improve its bottom line. Remarkably, BNP continued to engage in this criminal conduct even after being told by its own lawyers that what it was doing was illegal."

This is the first time a financial institution has been convicted of violating U.S. economic sanctions which undermines the international diplomatic tools that safeguard our national security and also disrespects "the most important values in the international community – respect for human rights, peaceful coexistence, and a world free of terror." So it’s not surprising that the DoJ punished BNP Paribas with a historic $8.9B fine, reflecting the amount that it illegally moved through the U.S. financial system. While U.S. financial institutions are strictly forbidden from engaging in business with OFAC sanctioned entities, investors purchasing international stocks, ADRs, or foreign ETFs can sleep easier knowing that ESG data regularly incorporates and screens which companies have business activities in U.S. sanctioned countries.

#4 JPMorgan Chase: When an asset is a liability, $13B

In 2013 JPMorgan was taken to task for its role in causing the 2008 financial crisis. The company agreed to pay $13 billion, which at the time was the largest U.S. corporate settlement in history.

The Diamonds in the Rough:

- JPMorgan Chase (which, through buyouts includes Bear Stearns and Washington Mutual) knew that huge numbers of the residential mortgages that they were acquiring were in trouble.

- Their own quality control processes revealed that a substantial portion of the loans were questionable, and would have disqualified many of them (if anybody was following the rules).

- But, in the name of making a buck, they bundled them into residential mortgage-backed securities anyway, and (wait for it) sold them to unsuspecting investors as if everything was just fine.

Once again, it may be a small comfort to consumers that the record-breaking settlement included $4 billion in aid in the form of loan forgiveness, loan modification, and targeted originations. Jamie Dimon led JPMorgan with more restraint during the mortgage boom and even warned shareholders about the trouble the industry faced. So what’s the lesson here? The bank acquired liabilities from Bear Stearns and Washington Mutual’s fraudulent mortgage practices. To this end, ESG analysis could be helpful in both assessing stand-alone company risks as well as the risks from previous and potential acquisitions.

#3 Volkswagen: Cheating on emissions tests and then lying about it, $14.7B

Talk about a scandal. Volkswagen got caught cheating on emissions tests and deceiving its customers. In June 2016, the German automaker agreed to a $14.7 billion settlement with the U.S. government.

Key Drivers:

- The diesel vehicles in question were actually capable of meeting emissions requirements, but the emissions control systems were only activated when the cars were being tested.

- Under normal driving conditions, the emissions control systems were disabled — meaning that the cars failed to meet emissions regulations in practice.

- In reality, the not-so-clean engines spewed up to four times the legal limit of nitrogen-oxide and greenhouse-gas pollutants behind such problems as smog, acid rain, and climate change.

Yes, they actually invented a "defeat device" that detected when the cars were being tested for emissions and turned on full emissions controls during that time. Of course, unsuspecting customers bought these vehicles on the premise of superior mileage and environmental sustainability marketing and had no idea that they were driving around in illegal pollution-mobiles.

As part of the settlement, Volkswagen will spend up to $10 billion on a buyback and lease termination program for nearly 500,000 affected cars, and $4.7 billion will go toward pollution mitigation and development of zero-emission vehicle technology.

#2 Bank of America: Another case of financial fraud, $16.65B

In 2014 Bank of America paid out the largest settlement in history (at the time) for financial fraud leading up to and during the mortgage crisis of 2008. Like several other banks on this list (see #8, #6 and #4), the U.S. government concluded that Bank of America helped exacerbate the financial crisis by engaging in unlawful conduct. However, Bank of America, as well as the other banks, did not plead guilty to any criminal wrongdoing.

The Dirt Underneath the Rug:

-

The company ignored its own red flags about issuing securities based on low-quality mortgages, and it lied to investors about it too.

-

It knowingly unloaded toxic mortgages that it knew were risky and likely to fail, representing them to investors as quality investments.

-

The settlement included damages caused by Countrywide Financial and Merrill Lynch, which Bank of America purchased in 2008.

Like Goldman, the bank lied to investors about the quality of its residential mortgage-backed securities, but it also was responsible for the origination and underwriting of many of the bad mortgages in the first place. Once again, a portion of the settlement ($7 billion) went to relief for consumers who were struggling as a result of the bank’s actions.

ESG data places a strong focus on corporate governance. Warning signs existed, from John Thain’s paying $4 billion in bonus payments to Merrill Lynch executives (including $10 million to himself) while the bank racked up a $15 billion fourth-quarter loss. Meanwhile, while Lehman Brothers was preparing to file bankruptcy, Bank of America executives decided to purchase Merrill Lynch in less than 24 hours at a 70% premium to its share price, and additionally failed to disclose Merrill’s mounting losses before a shareholder vote for the merger.

#1 British Petroleum: Criminal manslaughter and environmental crimes, $20.8B

You might recall the gripping images of horrific wildlife contamination, accounts of BP’s dismal safety record, or even seen the Hollywood movie depicting the worst oil spill in U.S. history. In 2016, British Petroleum was found guilty of criminal manslaughter and environmental crimes and ordered to pay $20.8 billion — the largest fine ever levied by the Department of Justice.

In April 2010, after months of frustrating efforts to finish the "well from hell," the Macondo well beneath the Deepwater Horizon oil rig blew out, causing a series of explosions that tore the rig above from stem to stern dumping more than 130 million gallons of oil into the Gulf of Mexico over the course of 87 days.

The Legal Spillover:

- BP was found to be "grossly negligent" and the story of the disaster reveals a fatally flawed well design, faulty emergency equipment, inadequate safety precautions and an emergency contingency plan rife with errors and miscalculations.

- BP pleaded guilty to eleven counts of manslaughter for the eleven crew members who died.

- Following the disaster, BP played down the severity of the spill, and even lied to Congress about how much oil was leaking leading to a guilty plea of obstruction of justice.

- Additionally, it paid civil penalties for violation of the Clean Water Act and claims for natural resource damages and economic losses in five states.

- In addition, the company faced a $525 million fine from the SEC for hiding information from investors, and three of its employees were indicted on criminal charges.

In the decades prior to the Deepwater Horizon spill, BP had a history of accidents resulting in deaths or felony convictions. In a standard industry metric measuring work-related industries, BP’s combined contractor and employee injury frequency was significantly higher than industry average in the years prior to the spill and between six to eight times higher than Exxon Mobil for instance.

What’s an investor to do? Consider incorporating a Mindful Investing strategy going forward.

DoJ investigations and punishments are only one part of the equation. If we want companies to step up to the plate and avoid these kinds of practices, investors need more than ex-post facto fines as the stock market reacts faster in punishing these stocks than the DoJ.

We all have responsibility for how we live and the companies in which we invest. As consumers, we need to be informed about what we’re buying, and what are the true costs. As investors, we should not only be focused on financial metrics, but also the ESG risks faced by the companies in which we invest. Multi-billion dollar penalties certainly impact a company’s bottom line and its valuation, especially as corporate assets have shifted from hard assets like factories to assets like intellectual capital and brand value.

Managing ESG risks should translate into favorable financial metrics over the long-run, if not the short-run too. We should be aware of how companies manage and account for their actions. After all, identifying business risks can help lead investors to spot opportunities in companies with strong ESG practices or in industries less likely to be entangled with costly regulatory actions. Censible can’t promise that a mindful investment portfolio will prevent these kinds of corporate risks and wrongdoing — but we believe it is a step in the right direction.