Why Mindful Investing Outperforms

SRI-minded companies can attract mindful investors and outperform their peers

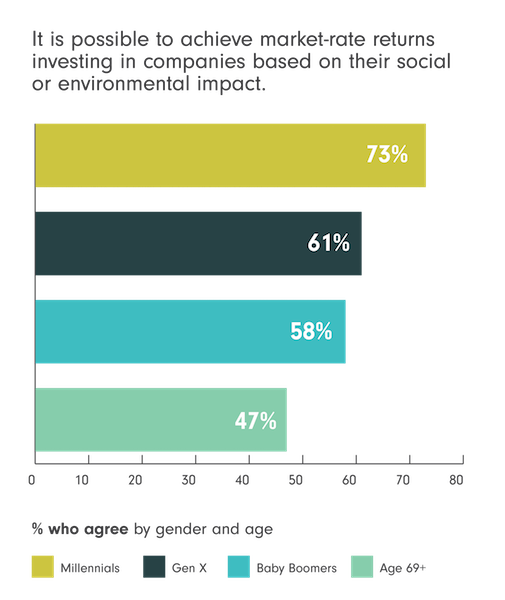

It’s a common misconception. For some reason, people have a hard time believing that it’s totally possible to meet your financial goals without sacrificing your beliefs.

Make money? Stay true to your values? INCONCEIVABLE!

But the truth is, there is plenty of evidence out there to dispel the myth that values-driven investing can’t keep up with traditional investment strategies. New research, better data, and modern technology give investors a much clearer picture into how a company is run. And it turns out, companies that do good, also do very well.

Mindful investing: What it is, and what it isn’t

Mindful investing goes by many names. Socially responsible investing. ESG-integrated investing. Values-guided portfolio management. We prefer to call it mindful investing. Despite all the evidence that shows that mindful investment performs as well or better than conventional strategies, many people simply don’t understand what mindful investing means.

It’s not philanthropy — although many nonprofits manage their investments using SRI practices, and many mindful investors value companies with a commitment to philanthropy. It’s not political action — although mindful shareholders often engage the companies they invest in to change their environmental, energy, human rights and labor practices.

We believe that mindful investing is purpose-driven, thoughtful and savvy. You wouldn’t buy a house without a structural inspection. Why would you invest in a company without knowing how well it’s run? A mindful investor is someone who make decisions based on data, and considers the whole picture before deciding where to put their money. They look at financial performance, and the long-term value of a business based on a number of non-financial factors.

Livin’ the good lyfe: good companies do good business

Whether you think of yourself as a shrewd “traditional” investor, or a values-driven mindful investor, chances are, if you’re having success in the markets, you’re investing in companies with strong commitments to corporate social responsibility and environmental, social and corporate governance principles. And there are plenty of examples out there, however you define the good guy.

Double down: good companies to work for = good investments

Case study: Milton Moskowitz, co-creator of the annual 100 Best Companies to Work For list, had a theory that the happiness and engagement of a company’s workforce might correlate with improved financial returns. Jerome Dodson, founder of Parnassus Investments, gave this hunch a real-world trial—creating the Parnassus’ Workplace Fund (PARWX) built entirely upon the premise that companies that are the most rewarding to their employees will also be rewarding to investors. In the 10 years since its inception, the fund has outperformed the S&P 500 nearly two-to-one, and now has over $1.25 billion under management.

“Treating people well and authentically respecting them does lead to far better business performance. We proved it works,” Dodson told Fast Company in 2013.

Follow the leaders: mindful investing is growing for a good reason

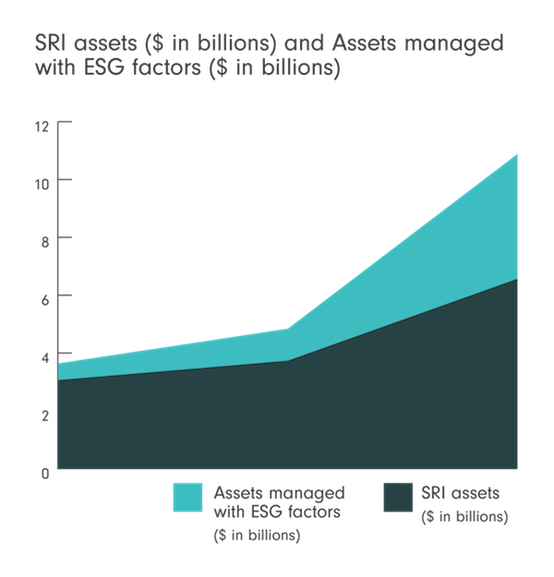

A-B-C-D-ESG… Between 2012 and 2014, the number of SRI assets climbed by 76 percent to $6.57 trillion. Much of that growth can be attributed to the widespread integration of ESG factors alongside traditional financial analysis in asset management.

The last several years have shown tremendous growth in mindful investing because a growing number of investment advisors and fund managers realized that they were missing the boat and started copying what the most successful players in the industry were doing: jumping on the SRI bandwagon.

It’s not your grandpa’s SRI: Modern mindful investing has come a long way

Today’s mindful investing is a far cry from the values-led investment strategies of the past. Most of the history of the SRI movement has been about not investing in companies that don’t support your personal values, regardless of their financial performance. Now, investors have access to tools that enable them to find stocks that meet their financial goals, and their ethical criteria. The emphasis has shifted from withholding capital from the “bad guys” to finding and supporting the strongest performers, tailored to whatever your definition of “good guys” may be.

Thanks to rapidly developing technology, increasing availability of information, and widespread adoption of sustainable business practices, those “good guys” are easier to find, more numerous and more successful. And that’s good news for everyone.