Mindful Investing 101

Breaking down the terms of the trade

CSR, SRI, ESG, impact investing, community investing, mindful investing, shareholder action… What the what?!

Mindful management of your financial portfolio can feel mind boggling. It’s a complicated business. And, the financial industry loves acronyms. But sift through all that jargon, and you just might find some stuff that makes a lot of sense.

Mindful investing: om with oomph

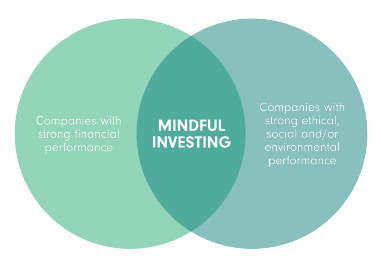

At Censible, we choose to skip the acronyms and use the term “mindful investing.” Mindful investing is exactly that—mindful. As in: Purpose-driven, thoughtful, smart. A mindful investor is someone who makes decisions based on data, and considers the whole picture before deciding where to put their money. They look at financial performance, and the long-term value of a business based on a number of non-financial factors.

We believe that mindful investing is a conscious commitment to an investment strategy with the intention of growing your wealth and supporting your personal values.

Some aspects of mindful investing put more emphasis on social outcomes, whereas others are focused more on financial returns. It’s not one or the other—it’s both. Have your cake, eat it, and take home leftovers.

With great power comes great responsibility: CSR and SRI

Responsibility is a major factor when you’re investing your money, whether you’re a billionaire or a ten-thousandaire. You want to steward your resources, and you expect the companies you invest in to behave responsibly with theirs.

CSR (corporate social responsibility) policies and platforms help companies understand and manage the impact of their business on the rest of society. (Financial Times)

CSR refers to a company’s efforts to understand and mitigate its effects on the environment and social well being. That sometimes means abiding by self-created principles, and other times following a set of standardized practices like Triple Bottom Line. Google famously sums it up in its business slogan: “Don’t be evil.”

If you’re looking to reward good corporate behavior, punish bad behavior, or simply want to feel good about the companies you invest in for reasons beyond financial return, you’ve entered the realm of SRI.

SRI refers to socially responsible investing, or (depending on who you ask) sustainable, responsible and impact investing. SRI strategies seek to balance financial performance with social, ethical and environmental impact. (Financial Times)

SRI strategies run the gamut from emphasizing financial returns to emphasizing social returns. Many SRI portfolios invest in companies with strong financial performance and environmental or social track records, yielding returns at or even above market rate. On the more altruistic side, investment strategies such as impact investing and community investing are designed to grow social good, and target a range of returns that are below market rate. And, often at the confluence of political action and finance, strategies such as divestment and shareholder engagement and activism, enable investors to express disapproval of specific industries or practices and/or advocate for change.

Like all matters of ethics and values, the question of what it means to be “socially responsible” is extremely subjective, and not very specific. Mindful investors use a variety of criteria to determine their own definition, and various tools to find and invest in firms that embody social responsibility as they see it.

Find out who’s naughty or nice: ESG screening

Monitoring and measuring a corporation’s behavior can be tricky business. How do you know? The answer for some investors lies in analyzing ESG (environmental, social and governance) reports to learn how companies perform on issues beyond financial return.

ESG indicators provide investors with quantitative data about non-financial performance, enabling evaluation of a firm’s performance on environmental and social matters, as well as its corporate governance policies.

What’s more, a growing body of evidence indicates that firms with a strong commitment to excellence in ESG factors also outperform firms without such a commitment. Deutsche Bank’s 2012 report “Sustainable Investing: Establishing Long Term Value and Performance” found that companies with high ESG ratings outperformed those with lesser ratings 89 percent of the time.

Many institutional investors have integrated ESG screening into their portfolio selection process—and not just for those products marketed as being socially responsible. Why? Because ESG factors have continued to be strong indicators of a well-governed organization, and well-governed organizations tend to be the best performers.

All investment strategies involve risk. Things happen. Companies and people make mistakes. Markets tank. Or, smart people come up with something revolutionary and wildly successful. There are dizzying highs, and heart-breaking lows. We know this in our hearts and in our heads. It really comes down to who you trust with your money—the companies that are driven by the short-term profit at all costs? Or those that are responsible across the board, especially if their practices align with what you think is important?