News Travels Fast: Risk and Reward in the Information Age

You can’t keep a secret

In the age of social media and the 24-hour news cycle, there's really no such thing as keeping a secret. Good news or bad, a juicy story can spread like wildfire. When it's a headline-grabbing scandal or disaster, news travels even faster, and corporate PR has little say in how the story goes down.

Photo from Twitter, via The Guardian

Some companies still try

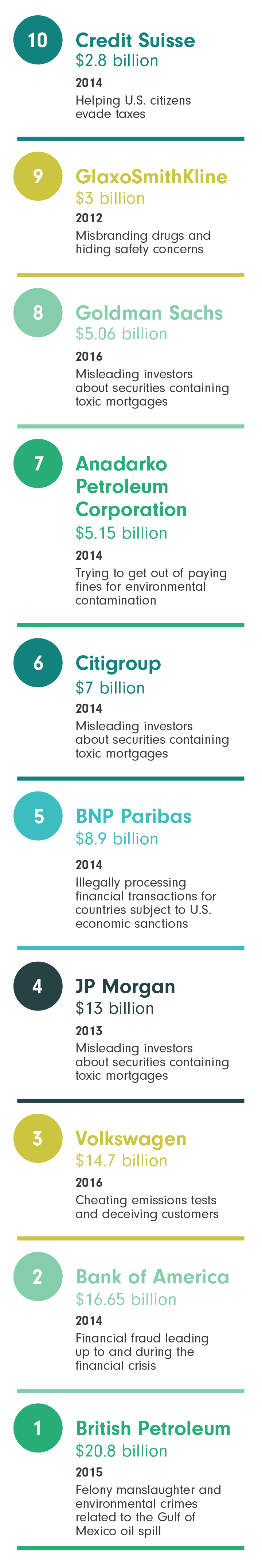

Even though history shows that bad behavior eventually gets found out, some people still try it. The allure of power and profit, a sense of invincibility... whatever it is, the dark side has a compelling call, and corporate crookedness is still a thing.

Source: U.S. Department of Justice

And when it hits the fan…

It makes a big mess.

Whether smaller-scale issues or major catastrophes, disasters are tragic on a human level: real people suffer. And, especially if incompetence (or worse) comes to light in the aftermath, a disaster or crisis can be a business’s undoing. Depending on the scale, a catastrophe and its aftermath can snowball and throw what once seemed like a stable company into a tailspin.

These worst-case scenarios have several things in common: a significant drop in stock price, a sustained period of underperformance, poor post-event management and reputation loss, negative brand exposure, senior management turnover, lack of effective communication, increased regulatory activity, and quite often, takeover.

An ounce of prevention

The question for business leaders and investors is: How do you manage and prepare for risks? According to numerous studies, the answer lies in ESG (environment, social and governance) data and CSR (corporate social responsibility) efforts.

The data can tell you how well-prepared a company is for a disaster or how they are planning for their future. They tell you if the company has risk factors like human rights issues in their supply chain, or an undue reliance on fossil fuels. Poor ESG performance may suggest that a company is a higher-risk investment.

And a track record for ESG performance can create a “halo” effect, softening the impact of a crisis, should one occur. Companies with positive reputations for environmental, social and governance tend to have a better chance of weathering a crisis.

Photo credit: Tim Lenz

Risk & responsibility

No one wants to be responsible for a corporate scandal or preventable tragedy. And it’s tempting to pass the buck. Some people like to blame big corporations, robber barons and greedy bankers. Some people like to blame investors for cultivating a ruthless focus on short-term profits. Some people think it’s a conspiracy.

Whatever your role in the equation, we all own a little piece of the problem. Executives and boards control the choices they make. Shareholders and consumers do, too.

Whatever your role in the equation, we all own a little piece of the problem.

Executives can use ESG data and embrace sustainable practices to help mitigate their risks and improve operational performance. Investors can use it to choose companies that are well-managed. Or you can take it a step further, and use ESG analysis to choose investments that live up to your personal values. The point is, ESG data are available and telling.

The bottom line: reward

Sometimes things go terribly wrong. Sometimes it’s caused by incompetence, sometimes it’s the result of purposeful deceit or unethical practices. Sometimes, it’s totally out of anyone’s control. And when things go wrong, they tend to also go public. Quickly. Which can create a shock effect, sending the (allegedly) culpable companies, and their stock prices, into a downward spiral.

At the end of the day, we believe in a margin of safety. Whether we evaluate a company’s debt, or their ESG risks, better information can help you make better decisions. Investing according to ESG concerns can be personally rewarding -- providing alignment with your values -- and financially rewarding, too.

As an investor, you own part of each company you invest in. Just like when you buy a car, or a computer or a piece of fruit at the grocery story, your choice to invest in a company carries a financial and an ethical responsibility. It’s up to you to be mindful about your risk.