Investing 101

A straightforward introduction to investing, designed for the mindful investor

Mindful investing starts with informed decisions. And a little basic investment knowledge can go a long way in helping you make sense out of the financial world.

Start at the beginning. What is investing?

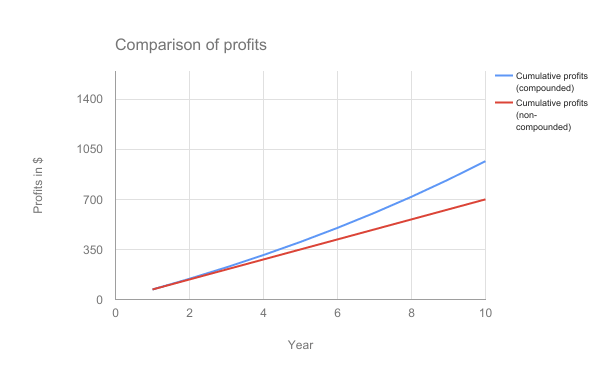

Investing means using money to make money (and then using that to make more money). You buy an asset with the expectation that it will increase in value over time. Sell that asset for a higher price than you paid, and you earn a profit. Reinvest your profits, and you can compound your investment, too. Compounding is a multiplying factor — basically, earning money from your earnings. Keep reinvesting, and ideally your earnings grow, and grow, and grow.

Disclaimer: This chart is for illustrative purposes only. It does not take into account any fees, costs or other expenses that would normally be charged on an investment account and reduce the profits therein.

Of course, you can invest in anything, but many people put money into things like savings accounts, real estate and financial securities (stocks, bonds, and so on). There are three basic categories of investments (adapted from Investopedia):

1 Ownership investments. You can own an asset that generates income and/or appreciates over time. Ownership investments are the most common — and they are also historically the most profitable. This category includes stocks or shares in mutual funds, real estate investment trusts (REITs), index funds or exchange-traded funds (ETFs). It also includes other things that you might own with the expectation of a return: real estate, precious/collectible objects or businesses. Ownership investments are also called equities.

2 Lending investments. You essentially become the bank or creditor, earning interest on money that you lend to someone else. Lending investments are generally lower-risk than ownership investments, but also tend to have lower returns. Bonds, Treasuries (T-bills) and certificates of deposit (CDs) are all examples of lending investments. They pay a set amount over a certain period of time, and are referred to as fixed-income securities.

3 Cash equivalents. This class of investment is comprised of highly liquid (easily turned back into cash) investments. It includes cash itself, as well as things like money market accounts, which are so liquid that you can write checks out of them as if they were cash. They are very low risk, and also tend to offer very low returns.

Investment is not a guarantee: Understanding risk

Investment risk refers to any uncertainty that could negatively affect your financial welfare. In other words, the very real possibility that your investments could lose value. Stock prices can peak, but they can also plummet. The markets are unpredictable, and it’s important to acknowledge that nothing is guaranteed.

You can’t eliminate risk, but you can manage it in several ways. One of the basic principles of risk management is summed up by the old adage: don’t put all your eggs in one basket. Many investors build a portfolio of investments. They divvy up their investments between ownership, lending and cash investments (aka different asset classes), choosing a mixture that aligns with their goals and risk tolerance. In technical terms, it’s called asset allocation — and it helps spread risk out across different kinds of investments. Investors can also select securities across a wide range of industries and sectors, a practice called diversifying. Both asset allocation and diversification work on the theory that a loss in one area is likely to be offset by gains in other areas.

Some investors also use data that measure environmental, social and corporate governance (ESG) performance to learn about how companies are preparing for and responding to risks (e.g., safety, climate change, or supplier labor practices). These data are increasingly accepted as factors that affect financial performance and are being used by growing numbers of investors to help mitigate investment risk.

Different investment strategies

Your financial goals and risk tolerance are personal — and your investment philosophy probably is too. Different strategies prioritize different things, and the way you choose to invest depends on what’s important to you.

If you’re all about potential, your strategy might fall into the realm of growth investing. Growth investing strategies seek to maximize capital appreciation and look for companies with above-average growth potential. Growth investments are evaluated for potential earnings increase, not just steady returns.

If you’re more of the level-headed bargain hunter type, value investing might be for you. These strategies actively seek out stocks that investors believe are underpriced, on the theory that share prices will go back up to normal (or its "intrinsic value"). Basically, you buy low, and sell high.

Where both growth investing and value investing strategies require some subjective assessment of an investment’s potential value, quantitative investing is a more mathematical approach. It can range from mathematically identifying drivers of stock performance to fully automated, rules-based investing that may employ data from any number of places — even Twitter.

Some investors look to additional factors to help manage risks and connect their investments to their personal beliefs. These often fall into the realm of SRI— socially responsible investing. SRI strategies look for investments with financial returns and positive social or environmental impact.

All these investment strategies rely on data to quantify an investment opportunity. Some use financial data alone to determine an investment’s potential value. Others integrate criteria for ESG performance to identify investments that align with investors’ ethical or environmental standards.

Eenie meenie minee mo: Making investment choices

It all comes down to what feels right to you. Investing is more than aiming at a dartboard and hoping for the best. You have options, and we think you should spend a little time getting to know them. Ask yourself questions about what matters most to you. Know your goals, understand your motivations, and figure out how to measure your progress. In our experience, people have a tangible connection to their financial plan, they are more likely to stick to it.

At Censible, we help our clients tailor their portfolios to their personal values. We call it mindful investing — consciously committing your resources to a strategy that grows wealth and supports your values. And whether you work with us or not, we believe you have a right and a responsibility to understand your wealth and hold your investments accountable to your standards.