Can Corporate Social Responsibility Change the World?

To be, or not to be… responsible

Big corporations often shoulder the blame for contributing to a long list of societal ills. But what if those companies decided to actively solve these problems? What if ethical corporate behavior and shrewd business management led to a strong economy and a better world for us all?

Unprecedented growth in corporate social responsibility (CSR) initiatives is increasing companies’ awareness of their own environmental and social impact. Investors are integrating environmental, social and corporate governance (ESG) data into their decision-making. Social enterprises are making profits in ways that address societal issues. The socially responsible investing (SRI) sector is growing at a brisk pace. It all adds up to a clear, growing public interest in companies that behave ethically.

The idea that corporate social responsibility could solve social and environmental issues is intriguing. Can “do-good” aspirations bring home the bacon? Can CSR really change the world?

Hold up. What exactly is CSR?

Broadly defined, corporate social responsibility (CSR) is the way a business contributes to and supports the wellbeing of the community in which it operates. It’s part ethical code of conduct: a company’s goals and aspirations relative to their environmental and social impact. And it’s part measurement and performance evaluation: tracking and analyzing environmental and social factors that indicate a company’s progress in achieving its objectives. Ultimately, CSR helps enable companies to understand and address their social and environmental impact.

That can take on a lot of different shapes, depending on the company, its leadership, the industry, and the community in which the business operates.

Show me the good(s). What does CSR look like?

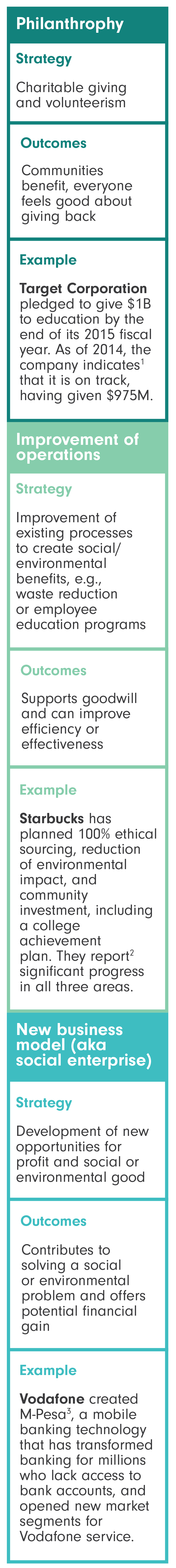

In a 2015 review of CSR programs, Harvard Business Review classified CSR efforts into three handy categories (we paraphrase):

-

Philanthropy — charitable efforts that don’t pad the bottom line, but do make people feel good and help support communities

-

Incorporating CSR into current business model — changes to existing processes that result in environmental or social benefits and improve effectiveness

-

Making CSR into the business model, aka social entrepreneurship — turning a social/environmental challenge into a profitable business opportunity

Apples to apples: Comparing CSR models

How do I know who’s actually responsible?

As an investor, you can decide for yourself what level of corporate social responsibility you care about in your holdings. But, how do you know who is really behaving responsibly?

It’s a good question: there’s criticism of CSR. Many companies share their goals, aspirations and progress in annual sustainability or CSR reports. But these reports are often self-produced, and data is essentially self-reported. Standards and frameworks are emerging, but there are inconsistencies in the various philosophies, and in much of the world, adherence to any of the frameworks is voluntary.

Critics of CSR question the rigor and quality of the data. They often characterize CSR and sustainability reports as insincere marketing fluff, and lobby for more transparent, objective analysis. And, in some cases, they are probably right. We’ve been through a long history of environmental and social exploitation in the name of profits.

And yet, today we have more information and better technology at our disposal, making it easier to identify genuine CSR efforts versus PR stunts. In addition, it’s becoming standard practice to seek independent assurance of CSR reports from auditors, accountants or other consultants.

Photo credit: Yi Chen

The good news is, a company’s progress and performance on environmental, social and corporate governance (ESG) issues is measurable.

Whether companies like it or not, ESG data are collected, analyzed and made available to the rest of us by some big, powerful, and trusted players in the financial industry. This information tells the story of a company’s management, risk-preparedness, and attentiveness to its social and environmental impact, which offers a pretty good gauge of how well they might be doing in relation to their CSR goals. Data analysis helps investors to make better-informed decisions about how sincerely responsible, accountable or ethical they believe a company to be.

A new world order

CSR weaknesses aside, there are people and enterprises out there banking on the idea that ethical corporate behavior can solve some big problems. And the idea that ethical businesses can change the world and generate profits is getting quite a bit of attention. In 2006, the Nobel Peace Prize went to social entrepreneur Muhammad Yunus and his company Grameen Bank for a microloan program that made entrepreneurs out of thousands of women in Bangladesh. And in 2015, hedge fund manager Paul Tudor Jones II shared his idea about how just corporate behavior is imperative to sustaining a capitalist system in a TED talk that now has more than 1.5 million views.

While no one can really say whether CSR is the solution to the ills of the world, we are seeing more public demand than ever for responsible corporate behavior. Mindful investing philosophies are integrating corporate responsibility factors into decisions, which in turn applies pressure for strong financial, social and environmental performance.

It looks like ethical business is good business. And, if Jones and his ilk are right, that’s good for all of us.